|

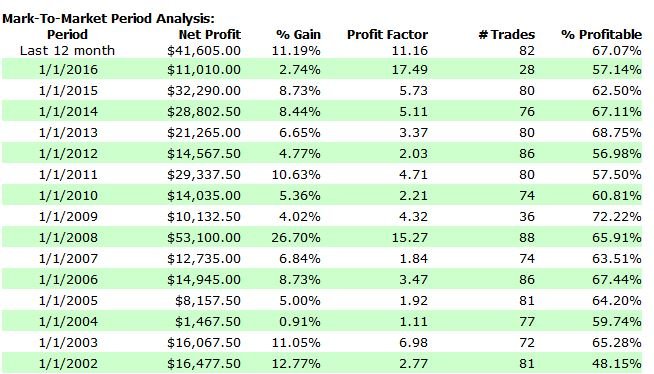

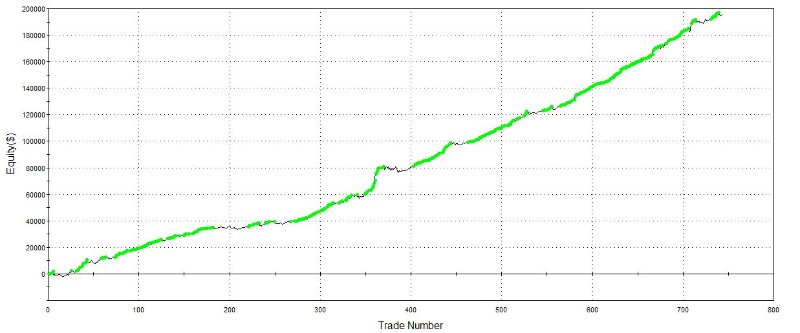

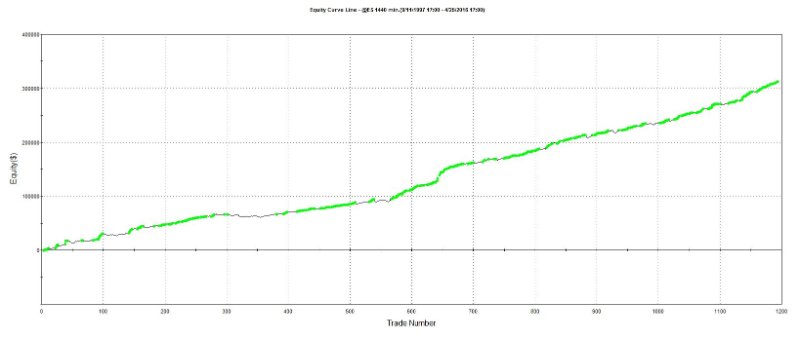

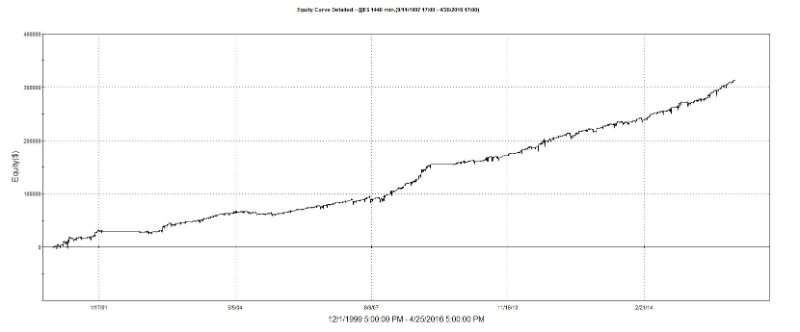

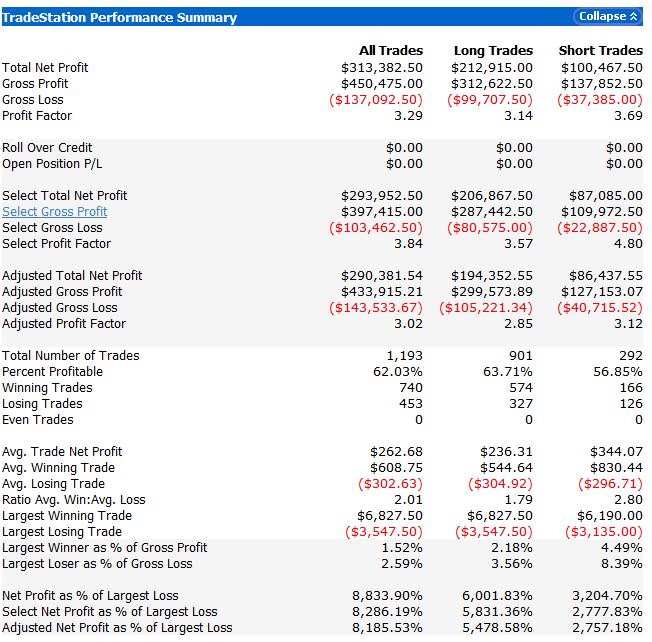

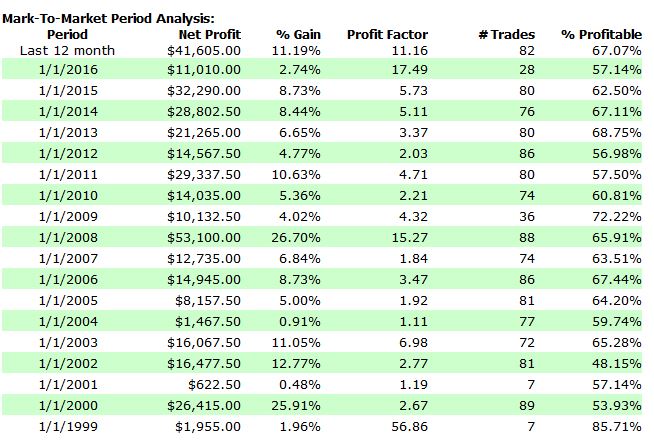

The ES_TRS_SR6t system that we will be launching shortly, is made up of a plethora of individual models/edges. I shared some results earlier from a generic GC(General Condition) Model/Edge, that was NOT optimized. Every non-dynamic input/value was pre-set to reflect time frame ( week, month, etc). GC Models = Edges designed to be consistent in all market conditions....slow n steady... CS Models (Condition Specific) = Edges designed to exploit specific biases, conditions, etc. CS models will always outperform a GC model while the market is in its designed condition/environment. GC models are implemented as a back-up.....safety net....to fill in any potential gaps, in case market decides to remain "Between Worlds" for some time. Here is the performance of that generic GC model. *Disclaimer: Historical performance whether live or simulated may not be indicative of future results. Trading Stocks, Options, FX, or Futures involves significant risks not suitable for all investors. Investors should only choose to invest funds he/she can afford to lose without impacting lifestyle. Price activity is not always predictable or repetitive, thus any strategy developed using historical data will be equally unpredictable. We do not guarantee our strategies or analysis methods will perform profitably and/or replicate results shown above, for any length of time. Before leasing/using our products, please consult your investment professionals, to discuss if our products are right for your risk tolerances & objectives. Price activity is not always repetitive or predictable, thus any strategy developed using historical data will be equally unpredictable. Here is the same Edge with only 2 inputs optimized, with with dynamic controls. Both the overall Risk profile and NetPft are both improved.....which is sometimes very hard to achieve. You can also see how tight the deviations are between Closed and Detailed graphs, which shows the robustness of entry to profit. Its rather easy to generate a great Closed Equity Curve, if you do not manage open position risk, but we actually focus more on mitigating open position risks, then we do closed risks, for obvious reasons. Another factor you have to consider, this is applied to ES Daily bar, which is a rather large bar size, when trading Futures systematically. From our research a 3 contracts Index Futures system, applied to a Daily bar, usually has Max $ risk Equity high to equity low, at any point in time, >$25K. However the GC model above maintains its risk $14K Max Risk. Obviously we cannot be certain this specific model will maintain this same risk profile for the next decade, or even the next day, but the difference between our systems and others.....if it doesnt and begins to fail, we have other thoroughbreds in the stable, ready to run. Now, we do not expect, nor will we ever rely on this model to perform exactly as it has in the past.....that is not logical, BUT what we can do, is use this performance to learn when/how to quickly identify & predict optimal solutions, and to set optimal ranges & logic for each model and the system as a whole. To constantly be searching/learning how & when to apply optimal solutions. Its imperative to not get caught up in individual model performance, as long as its consistent, concepts are based on fundamental & real-world justifications, and it meets performance mins, this is ok. We dont think historical performance will dictate exact future performance, however we feel its more like a Deviated range, but if you improve your starting point or initial classification, its easier to obtain an improved objective. We dont rely on Sharpe Ratio, or TSI, or RINA, or any individual performance metric or widely known metric formula.....instead we use a few different proprietary formulas to "Gauge" performance. We mainly search for time/consistency and low deviations between realized and unrealized performance. We search for models/edges, that have a quick (entry to profit) validation period....because we want keep % of time in the market as low as possible....while having a high trade frequency. We also do not get caught up in the "Its curve fitted" argument. If we include Model1A, and if it does not perform within its expected ranges into the future, it will not be considered for activation, thus it will not have a negative impact on performance. Both GC models above, are robust and could be traded as a stand-alone system, but we go light years beyond typical assumptions made by other developers/money managers, etc. As I said, GC models are merely as back-up plan....and rarely are they ever even activated.....in fact to date, not a single GC model has ever been activated, which speaks volumes to the quality of the CS models we include within each complete system. Below you'll see the yr to yr rolling. Notice how 2015, 2011, & 2008 outperformed other years. This is because the GC model above is designed to slightly outperform during Uptrends, however drastically outperform during Consolidations, Downtrends, and/or increased Volatility....as are many other of our models. *Disclaimer: Historical performance whether live or simulated may not be indicative of future results. Trading Stocks, Options, FX, or Futures involves significant risks not suitable for all investors. Investors should only choose to invest funds he/she can afford to lose without impacting lifestyle. Price activity is not always predictable or repetitive, thus any strategy developed using historical data will be equally unpredictable. We do not guarantee our strategies or analysis methods will perform profitably and/or replicate results shown above, for any length of time. Before leasing/using our products, please consult your investment professionals, to discuss if our products are right for your risk tolerances & objectives. Price activity is not always repetitive or predictable, thus any strategy developed using historical data will be equally unpredictable.

This model is Not compounded. It does not deploy any advanced money or risk management. It allows up to 3 contracts MAX per position, and 3 entries 1 contract per entry....however it rarely ever has 3 contracts open. This GC model is included within our ES_TRS_SR6t system, and we recommend $40K initial investment. This system is designed for the investor, NOT the "trader". Its applied to a Daily bar, and CS models always have much higher trade frequency than GC models, so actual complete system trade frequency is approx 6-12 trades per month, but it can go weeks without trading at all, until optimal conditions are identified or predicted. A variation of this system will be offered on our vast network of trading platforms & brokers. Please contact for additional details. Thank You Brian Miller

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

March 2018

Categories |

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Disclaimer: The principals of Optimized Trading understand regardless of the rigorous testing involving the development of systematic trading systems they are not infallible. Markets are dynamic and it may be necessary under special market conditions to intervene on the behalf of clients to protect their interests.

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Disclaimer: The principals of Optimized Trading understand regardless of the rigorous testing involving the development of systematic trading systems they are not infallible. Markets are dynamic and it may be necessary under special market conditions to intervene on the behalf of clients to protect their interests.

RSS Feed

RSS Feed